Sample Debt Collection Letter by Attorney

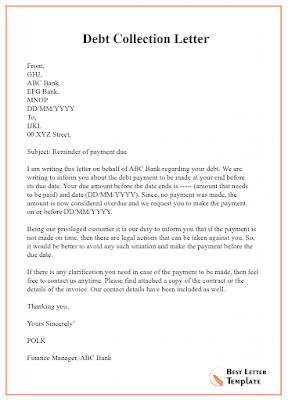

A debt collection letter is an official debt reminder that you either send (pay for) from your company or hire someone else to send it to a nonpaying client. You can mail a debt collection letter, to an individual consumer or a B2B customer. You do not need a credit check or proof of income in order to start the letter. You will still need to have a signed debt collection letter from you to prove that you did indeed follow the correct procedures.

Sample debt collection letters may be useful for some people. The best one to use may depend on what the debtor does with the letter and how far they go down the debt collection road. For instance, if you were going to call an old client and remind them of a past payment, you would probably want to make this letter very brief. A ten-word statement about the payment would be more appropriate than a three-page letter describing every last debt payment on the account. If you were going to send a formal notice of default to a credit card company, you would not want to include very much detail since the amount owed may already have been placed on the credit card company's books.

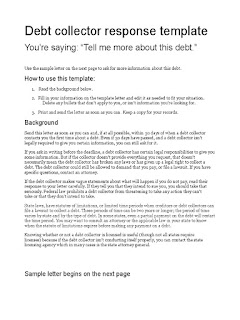

Sample debt collection letters can be a great first step, but it is up to the debtor to decide whether the expense of hiring a lawyer or paying a lawyer is worth the result. The best use of a sample debt collection letter may be to get paid or do not get paid. It can be a good way to get a debtors attention and show them that they are being too nosy. It can also be a way to start your attorney collection letters training.

Comments

Post a Comment